| Monthly Message | |

|

The Wutherich & Co. Composite was up 0.6% in August. This compares with the S&P 500, up 4.0%, the DJIA up 3.6%, the NASDAQ up 4.8%, the S&P/TSX up 2.1%, while the BMO Small Cap Index was up 2.3%. We continue to slowly pick away at some of our cheaper names while trimming some of our more expensive ones. We are sifting through other ideas to see if we can add something to the portfolio. When we do find something of interest, it generally proves to be too expensive! We think that this is a reflection of the environment that we are in. Perversely, we hope that September and October live up to their nasty reputations and cheapen some of our favourite stocks. Our wish is to buy great companies at good prices. In the current environment, we’d likely be chasing good companies at great prices. We would also like to point out a recent article by Tom Bradley which describes the plight of the average investor and how they deal with volatility in the stock market. Please click on this link to access the article. Embrace Volatility – Generate Better Returns |

|

|

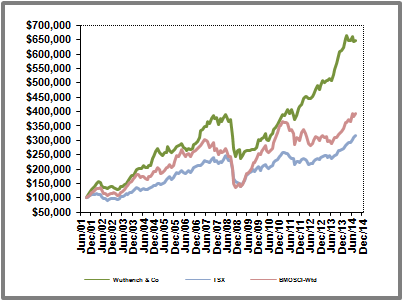

The following table illustrates the performance of the Wutherich & Co. Composite to the present: |

|

|

(unaudited, since Sep.30/01)*

|

| Month | 1YR | 3YR | 5YR | 10YR | Inception | |

| Wutherich & Co. |

0.6% |

18.6% | 18.7% | 19.3% | 12.3% | 15.6% |

| BMOSCI-wtd |

2.3% |

26.9% | 6.7% | 14.2% | 9.2% | 11.2% |

| S&P/TSX |

2.1% |

27.1% | 10.2% | 10.7% | 9.3% | 9.3% |

| Wutherich & Co. Factsheet | |

| Company Objective | |

| Our goal is to seek prosperity for our clients through participation in stable, growing companies in North America, led by strong management teams that we consider our partners for the next five or more years. | |

| Investment Philosophy | |

| Our style can be described as concentrated, disciplined, long-term growth stock investing. The focus is on established companies that generally have a demonstrated track record in revenue, cash flow or earnings per share growth, with strong managements and solid balance sheets. The current emphasis in the portfolio is on the equity of small to medium capitalization companies, defined roughly as $50 million to $5 billion in market capitalization. The portfolio may include large capitalization companies if the right elements are there. Stocks are bought with a keen eye to valuation, so you’re not likely to find many high multiple stocks here. The portfolio will likely maintain a significant percentage in foreign securities, providing exposure to investment returns outside of Canada. | |

| Portfolio Composition (as a percentage of net assets) | ||

| Canadian Stocks | 65.10% | |

|

Energy | 27.37% |

|

Financials | 0% |

|

Information Technology | 0% |

|

Communications and Media | 0% |

|

Consumer | 0% |

|

Healthcare | 6.49% |

|

Industrials | 21.14% |

|

Materials | 5.38% |

|

Telecom | 0% |

|

Transportation | 4.73% |

|

Utilities | 0% |

|

U.S. Stocks |

17.13% |

|

|

IndustrialS | 6.59% |

|

Specialty Retailers | 5.00% |

|

|

TRANSPORTATION | 5.54% |

|

Cash and OtheRS |

17.77% |

|

| Performance | ||||||||||

|

(unaudited, the growth of $100,000 invested as at Sep. 30/01)* |

||||||||||

|

||||||||||

| Your account with us | ||||||||||

| Wutherich & Company is an independent investment counsellor. We do not hold assets for our clients, but simply exercise trades over your account as per an agreed upon investment policy statement and portfolio management agreement. Your account is held at National Bank Correspondent Network in your name. Withdrawals from that account can only be sent to you at your designated bank account and/or address of record. Wutherich & Co. may also do withdrawals from your account to satisfy any fees that may apply to your account. All accounts are cash accounts. Unlike hedge funds, we do not use leverage or derivatives to manage your money. Also, we are not a fund company – if you are a private investor with us, your account will mirror the Model Portfolio but your investments are not pooled. | ||||||||||

| Other Facts | ||||||||||

|

||||||||||

|

*The Wutherich & Co. performance shown here is of a composite which combines the performance of all of the accounts managed by Wutherich & Co. that have been invested according to the Wutherich & Co. Portfolio throughout their history. These accounts vary greatly in the size of assets that they contain and whether or not fees have been deducted directly from the accounts during their history. BMOSCI-wtd = BMO Small Cap Index, Total Return, weighted. This index is currently the most comparable to the Wutherich & Co. portfolio due to its average market capitalization, though it may differ greatly in its sector weightings; TSX = S&P/TSX Total Return Index. Due to its large capitalization nature and substantially different sector weightings, this index may not be considered comparable to the Wutherich & Co. Portfolio. |

||||||||||

Monthly Message The Wutherich & Co. Composite was down 2.7% in July. This compares with the S&P 500, down 1.4%, the DJIA down 1.4%, the NASDAQ down 0.9%, the S&P/TSX up 1.4%, while the BMO Small Cap Index was down 2.3%. Over the last several months, we have seen downward pressure in some parts of the […]

Monthly Message The Wutherich & Co. Composite was up 2.0% in June. This compares with the S&P 500, up 2.1%, the DJIA up 0.7%, the NASDAQ up 3.9%, the S&P/TSX up 4.1%, while the BMO Small Cap Index was up 7.0%. Continued, strong performance by Energy and Materials names have propelled the Canadian indexes upward. These […]

Dear Clients and Friends, In the past, we have contacted you as to whether you would like to be on our email distribution list. In order to make sure that you still want to receive any messages and the monthly Newsletter via email, we are sending this notice. Please indicate if you would like us […]

Monthly Message The Wutherich & Co. Composite was up 0.2% in May. This compares with the S&P 500, up 2.3%, the DJIA up 1.2%, the NASDAQ up 3.1%, the S&P/TSX down 0.2%, while the BMO Small Cap Index was down 1.2%. Oh, but for a crisis of some kind! We haven’t had a good scare in […]

Monthly Message The Wutherich & Co. Composite was down 2.4% in April. This compares with the S&P 500, up 0.7%, the DJIA up 0.9%, the NASDAQ down 2.0%, the S&P/TSX up 2.4%, while the BMO Small Cap Index was up 2.6%. We posted a weak number in April as several of our strongest names and a […]

Monthly Message We would like to thank our Alberta-based clients and friends for having joined us in Calgary for our investment presentation and wine tasting at The Cellar. Cheers! We hope you enjoyed it as much as we did. The Wutherich & Co. Composite was up 1.4% in March. This compares with the S&P 500, up […]

One week to go till our presentation and wine tasting in Calgary. Please see the details below. There are still a few spots left so we encourage you to respond as soon as possible. Thanks to those of you who have already confirmed your presence. Cheers, Wil & JF

Monthly Message The Wutherich & Co. Composite was up in 5.1% in February. This compares with the S&P 500, up 4.6%, the DJIA up 4.3%, the NASDAQ up 5.0%, the S&P/TSX up 3.9%, while the BMO Small Cap Index was up 6.1%. We were blessed with another strong month in February. Rather than try to figure out […]

Monthly Message The Wutherich & Co. Composite was up 1.9% in January. As Jean-Francis was travelling at the time that we usually put out our monthly Newsletter (he was climbing Kilimanjaro!), we issued our numbers in our old “Factsheet” format. To make sure that this information reaches all of you, we are now sending an abbreviated […]

Comments and InterviewsYou may also enjoy Wil Wutherich’s various comments and interviews on the financial markets or press release on Wutherich & Company in these articles :

More articles to come...

Categories