| Monthly Message | |

|

The Wutherich & Co. Composite was up 3.6% in January. This compares with the S&P 500, up 5.2%, the DJIA up 5.9%, the NASDAQ up 4.1%, the S&P/TSX up 2.3%, while the BMO Small Cap Index was up 3.0%. Markets have been calmer and stronger in the last few weeks as it appears that the world is not ending, Mayans and Congressmen be damned! Things could heat up again as US budget talks and European debt instability re-surface. Regardless, we are very comfortable with most of the names in our portfolio and feel that many have good or very good prospects for years to come. In recent months, we have given examples of resilient companies that reside in our portfolio. This month’s example, HNZ Group, formerly Canadian Helicopters, is a “growth cyclical” story that we have owned since August of 2008. The stock has about tripled in this time. The company operates a fleet of helicopters which service the resource, utility and government sectors. Though the company has grow dramatically over the last five years, it is currently going through a slower period before it re-accelerates 18 to 24 months from now. In the meantime, the company remains very profitable, continues to earn a good return on invest capital, trades at a very reasonable valuation and pays out a solid dividend. Though HNZ may experience some turbulence in the coming one or two years, we think this company will have a home in our portfolio for some time to come. |

|

|

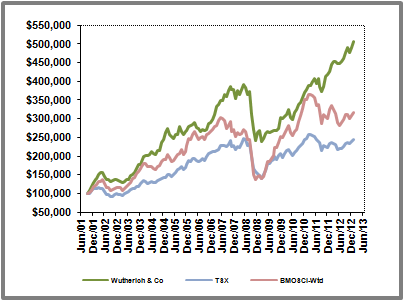

The following table illustrates the performance of the Wutherich & Co. Composite to the present: |

|

|

(unaudited, since Sep.30/01)*

|

| Month | 1YR | 3YR | 5YR | 10YR | Inception | |

| Wutherich & Co. |

3.6% |

19.0% | 18.9% | 7.5% | 14.2% | 15.4% |

| BMOSCI-wtd |

3.0% |

-2.5% | 8.3% | 4.8% | 10.5% | 10.7% |

| S&P/TSX |

2.3% |

5.0% | 7.5% | 2.2% | 9.5% | 8.2% |

| Wutherich & Co. Factsheet | |

| Company Objective | |

| Our goal is to seek prosperity for our clients through participation in stable, growing companies in North America, led by strong management teams that we consider our partners for the next five or more years. | |

| Investment Philosophy | |

| Our style can be described as concentrated, disciplined, long-term growth stock investing. The focus is on established companies that generally have a demonstrated track record in revenue, cash flow or earnings per share growth, with strong managements and solid balance sheets. The current emphasis in the portfolio is on the equity of small to medium capitalization companies, defined roughly as $50 million to $5 billion in market capitalization. The portfolio may include large capitalization companies if the right elements are there. Stocks are bought with a keen eye to valuation, so you’re not likely to find many high multiple stocks here. The portfolio will likely maintain a significant percentage in foreign securities, providing exposure to investment returns outside of Canada. | |

| Portfolio Composition (as a percentage of net assets) | ||

| Canadian Stocks | 70.81% | |

|

Energy | 20.40% |

|

Financials | 0% |

|

Information Technology | 0% |

|

Communications and Media | 0% |

|

Consumer | 5.04% |

|

Healthcare | 6.83% |

|

Industrials | 26.20% |

|

Materials | 5.99% |

|

Telecom | 0% |

|

Transportation | 6.36% |

|

Utilities | 0% |

| U.S. Stocks | 17.72% | |

|

Communication Services | 6.94% |

|

Energy | 5.64% |

|

Specialty Retailers | 5.14% |

| Cash and Others | 11.47% | |

| Performance | ||||||||||

|

(unaudited, the growth of $100,000 invested as at Sep. 30/01)* |

||||||||||

| Your account with us | ||||||||||

| Wutherich & Company is an independent investment counsellor. We do not hold assets for our clients, but simply exercise trades over your account as per an agreed upon investment policy statement and portfolio management agreement. Your account is held at TD Waterhouse Canada Inc. in your name. Withdrawals from that account can only be sent to you at your designated bank account and/or address of record. Wutherich & Co. may also do withdrawals from your account to satisfy any fees that may apply to your account. All accounts are cash accounts. Unlike hedge funds, we do not use leverage or derivatives to manage your money. Also, we are not a fund company – if you are a private investor with us, your account will mirror the Model Portfolio but your investments are not pooled. | ||||||||||

| Other Facts | ||||||||||

|

||||||||||

|

*The Wutherich & Co. performance shown here is of a composite which combines the performance of all of the accounts managed by Wutherich & Co. that have been invested according to the Wutherich & Co. Portfolio throughout their history. These accounts vary greatly in the size of assets that they contain and whether or not fees have been deducted directly from the accounts during their history. BMOSCI-wtd = BMO Small Cap Index, Total Return, weighted. This index is currently the most comparable to the Wutherich & Co. portfolio due to its average market capitalization, though it may differ greatly in its sector weightings; TSX = S&P/TSX Total Return Index. Due to its large capitalization nature and substantially different sector weightings, this index may not be considered comparable to the Wutherich & Co. Portfolio. |

||||||||||

Comments and InterviewsYou may also enjoy Wil Wutherich’s various comments and interviews on the financial markets or press release on Wutherich & Company in these articles :

More articles to come...

Categories