| Monthly Message | |

|

September was a positive month for the major market indices. The S&P 500 was up 2.6%, the DJIA up 2.7%, the NASDAQ up 1.6%, the S&P/TSX up 3.4%, while the BMO Small Cap Index was up 4.5%. The Wutherich & Co. Composite was up 3.3% during the month. Canadian large cap stocks were generally positive with the Energy, Materials and Healthcare sectors being the largest gainers. Canadian small caps were up in almost all sectors with strength concentrated in Energy and Materials stocks. With every other headline avowing that the world is coming to an end (by the way, the headlines in between seem to say that things are a little slow, but okay), you would be forgiven for stuffing cash into your mattress. We take heart in looking at the Wutherich & Co. Composite and feel that it is chock-full of resilient companies, some of which are slowing down a bit for now, but most of which are growing just fine in this environment. To give an example of resilience, lets focus on Hibbett Sports, a company that has been in our portfolio continuously since 2001. They have grown revenues every year since at least 1994. This includes 2007, the year of Hurricane Katrina (most of their stores are in the US South) and the financial crisis of 2008/2009. Interestingly, operating profit has nearly doubled from pre-crisis/Katrina levels in 2006. |

|

|

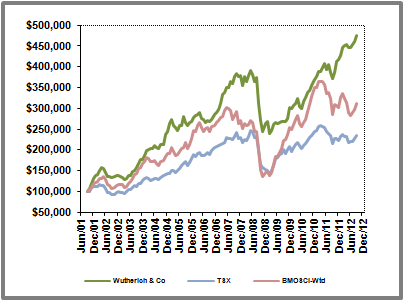

The following table illustrates the performance of the Wutherich & Co. Composite to the present: |

|

|

(unaudited, since Sep.30/01)*

|

| Month | 1YR | 3YR | 5YR | 10YR | Inception | |

| Wutherich & Co. |

3.3% |

28.3% | 20.9% | 4.9% | 13.7% | 15.3% |

| BMOSCI-wtd |

4.5% |

9.0% | 11.8% | 2.0% | 11.2% | 10.9% |

| S&P/TSX |

3.4% |

9.2% | 5.5% | 0.2% | 9.8% | 8.1% |

| Wutherich & Co. Factsheet | |

| Company Objective | |

| Our goal is to seek prosperity for our clients through participation in stable, growing companies in North America, led by strong management teams that we consider our partners for the next five or more years. | |

| Investment Philosophy | |

| Our style can be described as concentrated, disciplined, long-term growth stock investing. The focus is on established companies that generally have a demonstrated track record in revenue, cash flow or earnings per share growth, with strong managements and solid balance sheets. The current emphasis in the portfolio is on the equity of small to medium capitalization companies, defined roughly as $50 million to $5 billion in market capitalization. The portfolio may include large capitalization companies if the right elements are there. Stocks are bought with a keen eye to valuation, so you’re not likely to find many high multiple stocks here. The portfolio will likely maintain a significant percentage in foreign securities, providing exposure to investment returns outside of Canada. | |

| Portfolio Composition (as a percentage of net assets) | ||

| Canadian Stocks | 66.02% | |

|

Energy | 15.22% |

|

Financials | 0% |

|

Information Technology | 0% |

|

Communications and Media | 3.80% |

|

Consumer | 6.04% |

|

Healthcare | 7.14% |

|

Industrials | 23.22% |

|

Materials | 5.28% |

|

Telecom | 0% |

|

Transportation | 5.33% |

|

Utilities | 0% |

| U.S. Stocks | 16.94% | |

|

Communication Services | 5.88% |

|

Energy | 4.97% |

|

Specialty Retailers | 6.09% |

| Cash and Others | 17.04% | |

| Performance | ||||||||||

| (unaudited, the growth of $100,000 invested as at Sep. 30/01)* | ||||||||||

| Your account with us | ||||||||||

| Wutherich & Company is an independent investment counsellor. We do not hold assets for our clients, but simply exercise trades over your account as per an agreed upon investment policy statement and portfolio management agreement. Your account is held at TD Waterhouse Canada Inc. in your name. Withdrawals from that account can only be sent to you at your designated bank account and/or address of record. Wutherich & Co. may also do withdrawals from your account to satisfy any fees that may apply to your account. All accounts are cash accounts. Unlike hedge funds, we do not use leverage or derivatives to manage your money. Also, we are not a fund company – if you are a private investor with us, your account will mirror the Model Portfolio but your investments are not pooled. | ||||||||||

| Other Facts | ||||||||||

|

||||||||||

|

*The Wutherich & Co. performance shown here is of a composite which combines the performance of all of the accounts managed by Wutherich & Co. that have been invested according to the Wutherich & Co. Portfolio throughout their history. These accounts vary greatly in the size of assets that they contain and whether or not fees have been deducted directly from the accounts during their history. BMOSCI-wtd = BMO Small Cap Index, Total Return, weighted. This index is currently the most comparable to the Wutherich & Co. portfolio due to its average market capitalization, though it may differ greatly in its sector weightings; TSX = S&P/TSX Total Return Index. Due to its large capitalization nature and substantially different sector weightings, this index may not be considered comparable to the Wutherich & Co. Portfolio. |

||||||||||